Some EMS Stocks May Bounce

Some EMS Stocks May Bounce

By Hal Plotkin

CNBC.com Silicon Valley Correspondent

Mar 8, 2001 02:10 PM

After an interesting and disquieting few months, electronic manufacturing services (EMS) stocks, a soured sweet spot of the technology sector, could be ready to sweeten once more.

For only the second time in six and a half years, the group underperformed the Dow Jones industrial average last quarter by more than 3 percentage points.

The stocks came roaring back in January, though, moving up 59 percent over their fourth-quarter lows by January 25 – more than double the Nasdaq rebound that occurred during the same period. But a sharp pullback since then has left many investors scratching their heads.

Several analysts and fund managers are now saying select EMS stocks appear to be at or near a trough, though, and that if the past is prologue, EMS stocks will once again be the place to be. The factors cited most often include declining inventories at many EMS firms, indications of bottoming-out book-to-bill ratios that usually precede a recovery in the stocks, and volatility that has many of the stocks now trading well off their 52-week highs.

“I don’t think we’re going to see the kind of growth rates we saw in the past — 50 percent or more year-over-year,” says John Rutledge, portfolio manager for the Evergreen Tech Fund. “But we still like the group. You have to be selective, but the move to outsourcing has been a growth sector for the last decade and probably has five or six more years to go.”

EMS companies manufacture products for a wide variety of brand-name firms. EMS companies’ diverse customer bases usually provide more insulation from the product-specific or market-specific woes that can bring down individual tech firms with more limited product lines. The trend toward outsourcing also works to the advantage of EMS firms, as more and more brand-name manufacturers seek to cut costs associated with running their own, often under-utilized production facilities.

In recent years, for example, as much as 75 to 80 percent of EMS revenue growth has come directly from increases in outsourcing, with the rest coming from organic growth in end-user tech markets.

The betting now among many analysts is that EMS companies that serve the higher-margin, more sophisticated segments of the market will be the most dependable performers over the coming year. Analysts point to firms such as Celestica Inc. {CLS}, DDI Corp. {DDIC}, Plexus Corp. {PLXS}, Sanmina Corp. {SANM}, Flextronics International Ltd. {FLEX} and Jabil Circuit Inc. {JBL}. These firms concentrate on optical equipment and other similar new-product categories, a better client list than that of such firms as SCI Systems Inc. {SCI} and Solectron Corp. {SLR}, analysts say.

“If you think we’re heading for a sharp recovery, you’d probably be more interested in DDIC and Sanmina right now,” says J. Keith Dunne, analyst at Robertson Stephens, the San Francisco-based firm that hosts one of the best-attended annual EMS industry conferences. Dunne also recommends the stocks of Celestica and Plexus at current prices, saying all four companies share common and desirable characteristics.

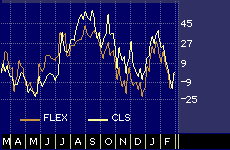

Flextronics and Celestica 52-week stock performance comparison

“All four are on the higher end of the technology spectrum, are well-managed, oriented to new product development, have diverse customer bases and very strong balance sheets. DDI and Sanmina will probably be the first ones leading out from here, but we’ve put all four on our wish list for 2001 for investors ready to get back into the market.”

Louis Miscioscia, EMS analyst at Lehman Brothers, based in New York, also sees a rebound in the not-too-distant future.

“Now might be to soon to jump back into the group,” he wrote in a research note published earlier this week. “But between now and when significant business ramps in the September/December quarters, there will he an optimal time to invest.”

Miscioscia currently has Flextronics and Celestica on his strong buy list, along with the somewhat lesser-known names Pemstar Inc. {PMTR} and SMTC Corporation {SMTX}.

Rutledge, the portfolio manager at Evergreen’s tech fund, currently owns the stocks of Flextronics and Jabil Circuit, and he also favors Sanmina. He says the latter may be slightly over-exposed to some weaker product segments, but which he nonetheless calls “a great company.”

“You want to stay away from companies that are heavily oriented toward PCs, such as SCI Systems and Solectron,” he says. “But we still think other EMS companies are going to show good growth year over year.”

Given the sector’s recent volatility, though, Rutledge says investors probably shouldn’t look for any straight-line trends.

So when does he think the sector will turn?

“The way things are going, I’d say give it another five minutes or so,” he says, with tongue in cheek.