A Sad Vignette

A Sad Vignette

By Hal Plotkin

CNBC.com Silicon Valley Correspondent

Mar 2, 2001 10:51 AM

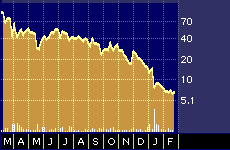

Given the many seemingly positive news reports about Vignette Corp.’s {VIGN} new marketing alliances, you might think the stock is a bargain now that it’s trading 95 percent below its 52-week high of 100 a share. But the experts beg to differ.

To be sure, the good news surrounding the company does look impressive, at least on the surface. The e-business application software firm broke even last quarter, says it expects to be profitable by the second quarter of this year and recently announced a series of new and strengthened marketing arrangements with industry heavyweights such as International Business Machines {IBM}, BEA Systems Inc. {BEAS} and PricewaterhouseCoopers.

Vignette’s total revenue for the fourth quarter ended December 31 increased to $123.9 million, representing a 203% increase over the fourth quarter of 1999 and a 12% increase over last quarter.

So what’s wrong with this picture? Quite a lot, if you dig a little deeper.

Vignette 52-week stock performance

For starters, like many tech firms, the company recently announced lowered guidance for the balance of 2001. On January 18, Vignette said it expects to post earnings of 9 cents a share on revenue of $500 million for fiscal 2001, and it added that reaching that goal will require layoffs of approximately 345 employees, or 15 percent of headcount. Analysts polled by First Call/Thomson Financial had previously estimated Vignette would earn 11 cents a share in 2001 on significantly higher revenue. The earnings warnings sent the stock plunging nearly 40 percent in just one day.

Several once-positive analysts who’ve been badly burned by the stock say the company has made exactly the wrong moves at exactly the wrong time. Vignette has jeopardized its future, they say, by shifting away from a core market that was gaining traction to one that is mostly spinning its wheels.

“Given the sharp downturn in Vignette’s business at the end of the quarter, we must rethink our investment thesis for this company, which has clearly been proven dead wrong,” Stephen H. Sigmond, an analyst at Dain Rauscher Wessels, wrote in a particularly stinging recent research note.

What worries some analysts the most was the decision the company made last year to de-emphasize the Internet content-management services on which it originally made its name in favor of a strategy aimed at penetrating the supposedly more lucrative electronic customer relationship management, or eCRM, market.

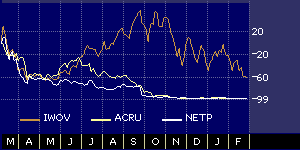

Interwoven, Accrue Software and Net Perceptions 52-week stock performance comparison

It turns out, say the analysts, that Internet content management is a far more stable and predictable business area than eCRM, which is beginning to resemble a corporate graveyard. Content-management software helps companies maintain and update complex Web sites efficiently and without costly bottlenecks. eCRM, on the other hand, comprises software that helps online companies personalize and manage individual relationships with consumers.

Although under pressure in a down market for techs, the stocks of leading content-management firms, such as Interwoven Inc. {IWOV}, are faring significantly better than many eCRM stocks — several of which are now near death, including Accrue Software Inc. {ACRU} and Net Perceptions Inc. {NETP}.

The reason for that is pretty simple. While content-management software can lower Web site production costs measurably, the earliest eCRM applications have often done just the opposite. Gartner Group Inc., of Stamford, Conn., for example, estimates that 60 percent of all eCRM software implementations to date have failed to live up to customer expectations. What’s worse, Ernst & Young LLP estimates that half of all companies can’t even measure the return on the investments they’ve made in eCRM projects.

“The ROI [return on investment] for eCRM is not as clear as for content management,” says Steven Frankel, an analyst at Adams, Harkness & Hill, based in Boston. “In this climate, customers are backing away from making investments in software that doesn’t deliver results to the bottom line.”

Most experts still think customer-centric eCRM solutions will be a growth center in the future and will eventually deliver the results that have been promised. But eCRM tools and techniques are still being developed, refined and modified for a variety of industries. That’s why it could be several quarters, or even years, before the applications are standardized and fully functional to the degree needed to deliver predictable results for investors in eCRM firms, including Vignette.

For investors with a high risk tolerance and long investment horizon, however, this could be a good time to take a small position in Vignette’s stock, some analysts believe.

“Nibbling would be probably about the right way to think about it now,” says Rehan Syed, an analyst at S. G. Cowen Securities Inc., based in Boston.

Syed was one of the few analysts to downgrade Vignette’s stock before it’s mid-month blowup in January. He says things are looking a bit better for the stock these days — that is, as compared with a few weeks ago.

“At these prices the risk/reward ratio has shifted in a more favorable direction,” he says. “The company is in a lot better shape than many others that have not lowered expectations. It puts them in a position where, if they can execute, they can beat the lowered expectations, which would certainly help the stock.”

But like the other analysts who once had more faith, Syed says current overall economic conditions make a strong performance by Vignette unlikely, at least over the short term.

“Overall,” he says, “I’d recommend continued caution. If we can get out of the first quarter without any more disasters on the software side of the market, the situation could improve. But Vignette has lost some precision and sharpness over the past six months that they will have to regain to be successful.”

Frankel, of Adams, Harkness & Hill, is even more blunt.

“It’s too late for Vignette to get back in the lead on content management, where Interwoven has won,” he says. “The company is going to need to find another segment, not looking for million-dollar eCRM deals, but something more practical, before the stock can recover.”