Analyst Pick: L-3 Communications

Analyst Pick: L-3 Communications

By Hal Plotkin

CNBC.com Silicon Valley Correspondent

Mar 19, 2001 08:00 AM

Who: John Rutledge, portfolio manager for the Evergreen Tech Fund.

Stock Pick: L-3 Communications Holdings Inc. {LLL}

Recent Price: $79.

Appreciation Potential: Expected to outpace tech stock averages.

Reason to Buy: Defensive tech stock play.

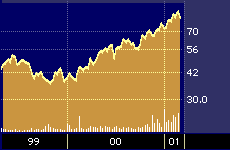

L-3 Communications 2-year stock performance

Investors looking for a defensive stock pick in the tech sector should take that phrase literally, says John Rutledge, portfolio manager of the Evergreen Tech Fund {ETCAX}.

That’s why Rutledge tabs L-3 Communications Holdings, Inc., a firm that serves the defense and aerospace electronics sector, as his favorite stock pick of the moment. L-3 is one of the few tech stocks, he notes, to have bucked the downward trend that has pushed so many other tech stocks sharply lower over the past year.

“We have to be 90 percent long [in tech-related stocks],” says Rutledge. “So we’ve successfully used L-3 as a defensive stock. It’s not an economically sensitive stock. If anything, the U.S. has been under spending in recent years on defense, and the most attractive area in defense is electronics.”

Although the company is already doing quite well, Rutledge says he expects L-3 to benefit further over the next few years from increased spending on defense once the Bush administration completes its pending review of the Pentagon’s long-range budget needs.

Depending on the specific product, L-3 Communications is either the number one or number two supplier of a variety of secure communications microwave components, avionics, telemetry and other high-tech instrumentation gear to the Department of Defense, related government agencies and defense contractors, as well as to telecommunications and cellular firms, according to data provided by the firm.

The company was formed in April 1997 as a consequence of the merger of Loral Corporation and Lockheed Martin Corp. {LMT} one year earlier.

Last month, L-3 announced that it had been awarded a contract by Raytheon Company {RTNA} to supply its tactical airborne recorders to the U.S. Navy’s SHARP (Shared Reconnaissance Pod) Program. The first SHARP system will initially fly on the F/A-18 E/F Super Hornet, which is a multi-mission, carrier-based, all weather, day/night strike fighter.

“SHARP is the most significant tactical airborne reconnaissance program awarded by the U.S. Department of Defense since 1996,” said Greg Roberts, president of L-3 Communication Systems-East, at the time the program win was announced. Roberts says the contract puts L-3 in position to capture additional business in the data storage and reconnaissance market, which is estimated to be worth more than $130 million over the next five years.

The Navy-related contract was just one of many other similar recent wins for the company lately, which also include new or extended contracts with both the Army and Boeing Company {BA}.

L-3 posted operating income of $222.7 million on sales of $1.9 billion in fiscal 2000, representing an increase of nearly 36 percent over sales of $1.4 billion in 1999. Diluted earnings per share over the same time period increased 35 percent to $2.37, as compared to $1.75 for 1999.

Rutledge says L-3 is extremely well positioned given the many consolidations and mergers in the defense industry over the past decade.

“There’s substantially less competition in that space today,” he says.

Rutledge also likes L-3’s senior management team, which is stocked with defense industry veterans from both Lockheed and Loral who he says know their way around the defense department.

“It’s a very experienced senior management team,” he says.

Rutledge says he doesn’t have any particular price target on the stock moving forward. But he says he expects it to continue to outperform the rest of the tech sector at least until there are signs of a rebound in core business and consumer technology end-user markets.

“We’d be lightening up and getting out if we see signs of a turnaround in traditional end-user tech markets for products such as PCs and cell phones,” he says.

Until then, he says, defense electronics, with its locked-in customer base and dearth of suppliers, is likely to remain one of the few bright spots in the otherwise barren tech sector.