In Intel vs. AMD, Neither Wins

In Intel vs. AMD, Neither Wins

By Hal Plotkin

CNBC.com Silicon Valley Correspondent

Mar 20, 2001 10:28 AM

Stiffening competition between chip giant Intel Corp. {INTC} and Advanced Micro Devices Inc. {AMD} is great for consumers, but not for investors of either stock, say analysts.

The very same factors that make this the best time ever to buy a computer also make it the worst time to hold either Intel or AMD stock, say industry watchers. The two rivals have gone tit-for-tat for years, offering ever-faster processing speeds, and cutting costs to edge the other out of the now slowing personal computer market.

“I don’t own either one because the glory days for the microprocessor manufacturers are behind us,” says John Rutledge, portfolio manager of the $14-million dollar Evergreen Tech Fund.

Wall Street is giving these former high flyers a jaundiced eye as demand for personal computers eases off record highs in recent years.

Although far from crashing, the growth in demand for new microprocessors for the next few years looks like it will be about half of what it was during the sector’s heyday period from 1980 to 1999 when the year-over-year growth rate averaged 18 percent, according to Rutledge.

For one, consumers aren’t rushing to buy a new PC because a 700 MHz-powered machine doesn’t perform much differently from a 1000 MHz computer. So, people are just replacing their old PCs, rather than upgrading to the newest, and fastest box.

The story is something of an object lesson on the advantages and disadvantages of tough head-to-head competition. Although a good race often leaves the crowd cheering, it can run the competitors ragged.

“When Intel and AMD have competitive technology and there is a surplus of supplies, it’s generally not a good time to own either stock,” agrees Scott Randall, an analyst at Wit SoundView, based in Seattle, Washington.

You throw into that mix the general slowdown in business spending on information technology products, and you have the recipe for the current slump in both stocks.

To be sure, both firms still do have their backers in the analyst community, though most of those endorsements are heavily qualified these days.

“The answer as to which stock is in the stronger position right now is very clear,” says Drew Peck, an analyst at S.G. Cowen Securities, based in Boston. “It’s AMD.”

Peck is far from an AMD cheerleader, though, rating the stock a “neutral.” Intel, with its production power and market share, could slash prices at just about any time and kill AMD.

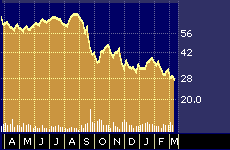

Intel 52-week stock performance

On a valuation basis, Intel is trading at about a four-to-one forward-looking P/E premium as compared to AMD, according to Needham & Co., despite the fact that AMD is finally offering a fully competitive line of microprocessors after decades playing second fiddle to Intel.

The P/E differential is significant, and it should work to AMD’s advantage over the coming quarters, says Needham’s analyst Dan Scovel.

“Intel’s dominance is not at risk at all,” he says. “In the near-term, we see AMD pretty comfortably positioned,” says Scovel, who rates AMD “strong buy” with a 12-month share price target at $50, and doesn’t cover Intel.

Looking at the slowing macro environment, analysts are mixed on which firm will end up on top.

“As the quarters pass AMD will show how much better things are for them in terms of price and performance,” says Eric Rothdeutsch, analyst at Robertson Stephens, who “buy” rating and a 12-month price target at $31.

Larger macro-economic trends will work to Intel’s advantage, counters Ashok Kumar, analyst at U.S. Bancorp Piper Jaffray, who rates Intel a “buy,” and AMD a “neutral.”

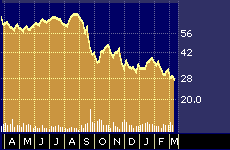

Advanced Micro Devices 52-week stock performance

Intel’s cash horde gives it the edge, says Kumar. Intel plans to spend $7.5 billion this year, in spite of declining revenue. The big cash investment is hoped to lead to lower-cost, higher speed chips, boosting margins and giving Intel the edge in a price war.

With that said, neither Intel nor AMD are off the races any time soon, says Kumar, who doesn’t see either stock recovering significantly until the second half of 2002, when a cyclical recovery should be in the works.

Kumar recommends buying Intel in the mid $20s and selling if the stock hit the high $30s. If a recession hits in the second half of this year, Intel could hit the low teens, warns Kumar, who also told CNBC.com this morning that he wouldn’t be a buyer of AMD’s stock at any price.