Uncertainty Lingers for Dell

Uncertainty Lingers for Dell

By Hal Plotkin

CNBC.com Silicon Valley Correspondent

May 17, 2001 08:15 AM

Dell Computer Corp.’s {DELL} recent termination of approximately 3000 employees is expected to help the company meet earnings expectations when the firm reports its first quarter performance on Thursday after the market close. But analysts are sharply divided on whether the worst is now behind Dell and its competitors in the hard-pressed personal computer sector.

Dell is expected to post revenues of $8 billion for its first quarter of this year, with earnings per share of 17 cents, according to First Call Corp. The company posted sales of $7.28 billion and 19 cents a share in earnings for the same period one year earlier.

On Tuesday, Merrill Lynch analyst Steve Fortuna swam against the PC sector’s pessimistic tide with an upbeat research note that suggests there will be a strong rebound in the growth rate of personal computer sales next year.

Most experts, including Fortuna, have already written off the balance of this year when it comes to reviving sagging sales of new PCs. The two most widely quoted PC sales growth forecasts, from International Data Corporation and Gartner’s Dataquest, now hover in the low single-digit range for 2001.

But Fortuna, who tabs Dell Computer’s stock as his top pick in the sector, says that the growth of sales of new PCs should swell to 17.5 percent next year.

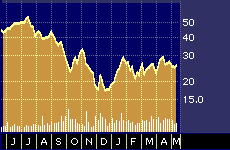

Dell Computer 52-week stock performance

“We feel next year could be surprisingly strong in light of the current deferrals coupled with a number of important growth drivers,” he says. Fortuna is counting on a revival of demand in Europe, a re-acceleration of domestic small business markets, and a sales spurt tied to the rollout of Microsoft Corporation’s {MSFT} next personal computer operating system, Windows XP. The Merrill Lynch analyst reiterated his “buy” rating on Dell’s stock this week, along with a $32 12-month price target.

The optimism about Dell’s prospects going forward is not, however, shared by many other leading PC sector analysts.

“I agree that inventory is not as bad as it was,” says Dan Niles, an analyst at Lehman Brothers, based in San Francisco. “But the bad news is there is just not a lot of demand out there.”

Niles scoffs at the idea that anyone can have an accurate grasp at this point in time about exactly when, or even if, the PC sector will return to substantially higher growth rates.

“If your clarity on the next six months is bad, how can you really have a great idea on what is going to happen two years out?” he wonders. “The big question,” he says, “is ‘what base are you working off of in 2001?”

Niles says it will be hard, perhaps impossible, to calculate forward-looking fair valuation levels for PC stocks until the overall outlook for PC sales comes into better focus.

“I think it is too early to call a bottom relative to softness in PC demand,” agrees Walter Winnitzki, an analyst at J.P. Morgan H&Q, based in New York. “All our end user checks suggest that things remain weak.”

Winnitzki says he’s telling investors not to buy into the PC group at the moment, although he makes an exception for Compaq Computer Corp. {CPQ} which is based, he says, on an attractive valuation and the company’s current movement toward serving more enterprise, or corporate-level, customers.

“Other than Compaq, we’re telling people they should remain cautious on the group,” he says. “It’s possible we could see a rebound in unit demand, but fundamentals may not follow to create a buy signal in terms of pricing.”

Winnitzki says competitive pressures in the PC sector, which have cut prices for top-end systems virtually in half over the last two years, threaten PC makers bottom lines even if their top lines grow.

Many experts and fund managers also say there are considerable doubts about top line revenue growth going forward for PC makers.

The PC market appears saturated, they say, with few PC owners feeling the need to upgrade their machines, particularly in the midst of an economic downturn of uncertain duration. Hopes that Microsoft’s next operating system, set to be released later this year, will lead PC buyers into the stores could also be misplaced, they say.

“XP is the first major upgrade since Windows 95,” says Rob Enderle, vice president of the Giga Information Group, based in San Jose. “But it’s not the revolutionary product the business community in particular has been looking for.”

Enderle says he expects initial sales of XP to be modest, especially when compared to the rollout of Windows 95. And that, he says, means consumers and business buyers probably won’t be flocking to buy new PCs.

A larger concern is that PC sales may never resume the growth rates that made stocks in that sector some of the best bets over the past two decades.

“PC’s are now a mature product category,” says John Rutledge, portfolio manager of the $14 million dollar Evergreen Tech Fund {ETCAX}. “The glory days are behind us.”

“It’s now a replacement market,” he says, likening it to the automobile sector, which has gotten very few investors excited in recent years.