Is AMAT Ahead of Itself?

Is AMAT Ahead of Itself?

By Hal Plotkin

CNBC.com Silicon Valley Correspondent

May 18, 2001 03:50 PM

Like several other leading names in the semiconductor manufacturing equipment group, Applied Materials Inc.’s {AMAT} stock is up significantly off its recent lows. But at least one prominent analyst is warning that if past is prologue, the stock, indeed the entire group, could be dangerously ahead of itself.

On Wednesday, Applied Materials reported second-quarter earnings of $269 million, or 32 cents a share, excluding a one-time restructuring charge. The earnings were a penny less per share than analysts had been expecting, according to First Call/Thomson Financial. The company earned $459 million, or 53 cents a share, during the same period one-year earlier.

“I believe that we are now in the bottom of this cycle and we are waiting for the tipping point,” Applied Materials’ CEO James Morgan said in a conference call with investors and analysts after the earnings announcement.

There’s some disagreement among experts, however, about exactly when that “tipping point” will arrive, notwithstanding the stock’s recent surge.

Semiconductor manufacturing stocks have staged an impressive rally over the past month, rising 23 percent as a group, with large caps within the sector up 46 percent off their April 4th lows, according to Merrill Lynch. The stocks have risen in large measure on hopes the cyclical industry, which supplies high-cost tools to chip manufacturers, is at or near the bottom of its current cycle.

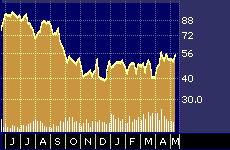

Applied Materials Inc. 52-week stock performance

What worries some analysts, though, is the fact that valuations for chip equipment makers such as Applied Materials have now risen to a level that has pretty much baked-in a recovery in 2002 that might not be as robust or as soon-to-arrive as some expect.

“Given that peak P/E’s historically reach 1x (times) the long term growth rate, valuation could return to about 30x (earnings) in 2002,” calculates Merrill Lynch analyst Brett Hodess. He says that implies a $65-$75 target range for Applied Material’s stock.

“We believe this is insufficient return given the high risk that 2002 may be a much softer recovery and the turning point may be further out than investors think, implying downside that is about equal to upside,” he says.

Historically, Hodess notes, semiconductor manufacturing stocks have not been able to maintain upward momentum unless orders for new equipment are trending up, which is not yet the case. Unless orders start trending up sometime soon, the stocks could be in for another slide, he says.

Hodess says that Applied Material’s stock could retrench to the low $40 range if order growth does not materialize over the next few quarters. Other stocks in the group, particularly large caps, would come under similar pressure, he says.

Backers of investments in Applied Material’s stock, on the other hand, say that the industry is in the middle of several critical equipment and process transitions that will require semiconductor manufacturers to purchase new chip making tools regardless of overall economic conditions. Those transitions include the movement toward larger 300-millimeter wafer sizes and copper-based connections on chips, both of which increase the efficiency of the manufacturing process, but also require a new generation of chip-making equipment.

Intel Corp. {INTC}, for example, has repeatedly pledged that it will spend its way out of the current downturn with $7.5 billion in fresh capital expenditures this year. The spending is designed to assure that the company has the latest and most efficient chip-making technology in place and operating before the next economic upturn.

The analysts don’t agree, however, about exactly when that spending will take place. Hodess estimates that Intel will have already spent about two-thirds of that sum by the middle of this year, which would leave little left to fill sector-leader Applied Materials’ coffers at the end of this year when its stock will rise or fall based on actual rather than projected earnings.

But others say their research indicates that Intel’s spending will be barbell shaped this year, with the bulk of it coming in the first and fourth quarters, which would help explain the recent slowdown in orders at Applied Materials.

Applied’s bookings fell 44 percent sequentially from $2.43 billion in the first quarter to $1.35 billion in the second quarter, which represents one of the sharpest sales slumps the firm has ever experienced.

“I think the sector has already hit bottom,” says Sue Billat, an analyst at Robertson Stephens, based in Palo Alto. “Hitting bottom this time was not quite as painful as prior downturns, although the contraction was more rapid.”

Billat says her confidence in the sector, and in Applied Materials’ stock in particular, is bolstered by the fact that the current slowdown in end-user demand is being felt most acutely in the end user markets for logic chips such as microprocessors, rather than the memory chip slumps that have contributed the most to previous disappointing seasons for chip equipment makers.

The difference this time, she says, is that unlike commodity memory chips, logic chips don’t have a very long shelf life because they quickly become obsolete. That means manufacturers wishing to keep up with demand cycles must discard out-dated logic chips in favor of manufacturing the more advanced integrated circuits that are usually in greater demand.

Billat has a “strong buy” rating on Applied Material’s stock, which implies an expectation of a 25 percent or more upside move over the next 12 months, according to guidelines used by her firm. She has the same rating on Novellus Systems Inc.’s {NVLS} stock, which is based, she says, on its recently demonstrated strength in 300 millimeter and copper equipment tool markets.

“The new chips will need to be made with the most modern and advanced technology,” she says. “That’s good news for the chip equipment industry.”

Hodess, on the other hand, says he has some concerns that the spending Billat and others project may not materialize, at least not by the end of this year.

Several large firms, including Intel, Infineon Technologies {IFX}, Taiwan Semiconductor Manufacturing Corporation {TSM} and Texas Instruments Inc. {TXN} have all previously announced plans to fire up 300 millimeter production lines during the second half of 2001.

“These are the specific projects that lead semiconductor equipment companies to project an uptick or a bottoming of orders,” says Hodess. “At the same time,” he warns, “if demand stays weak, we believe several of these could be reduced in scope.”

Given the hundreds of millions of dollars of equipment sales riding on each of these decisions the cancellation or slowdown of any one such project would deal a major body blow to the big chip equipment makers, he notes.

Michael Murphy, editor of the California Technology Stock Letter, says the group’s continuing recovery is certain and inevitable over time given the need semiconductor manufacturers have to transition to new production equipment.

He says that semiconductor manufacturers simply must invest in new production tools or watch as competitors who make those investments gain as much as a 30 percent cost-of-manufacturing advantage.

“If they don’t spend the money they are going to be out of business next year,” he says.

One thing most industry watchers agree on, however, is that Applied Materials has an excellent track record of coming out of economic downturns in a stronger position within its market than the company went into them.

“Gaining market share after a downturn has been a hallmark of Applied Materials,” says Billat.

She says the company’s size and marketing prowess — it often stations its own full time employees at customer production sites – helps Applied Materials anticipate customer needs better than many other competitors.

“Think of how expensive it is to put your employees on customer sites,” she says. “That’s something most of the little guys just can’t do.”